Before 2021, not many people in China knew about this company, and it has become the favorite of women from hundreds of countries and regions. Hidden in the urban village of Panyu, Guangzhou, it is —— SHEIN, a cross-border fast fashion brand with a current valuation of 100 billion yuan.

SHEIN is a cross-border fast fashion brand focusing on womens wear. It has entered North America, Europe, Russia, the Middle East, India and other markets. Its core business is self-operated womens wear sales, including product design, warehousing supply chain, Internet research and development, online operation and other full links. GMV is expected to exceed $100 billion in 2021, and many people compare SHEIN to fast fashion giant ZARA.

What is the state of SHEIN in the world, I use Appstore shopping list to explain.

SHEIN is the first in the shopping list out of 52 countries and ranks in the top 10 out of 83 countries and regions. What is this concept? Equivalent to Chinas Taobao, Pinduoduo.

The first time I knew SHEIN was in 2019, when I was making overseas e-commerce and researching competing products on the shopping list in Southeast Asia. I saw SHEIN and checked that it was still a Chinese company with its own clothing category. Later, I talked about some clothing suppliers to understand the difficulties in the cross-border clothing industry: the inventory was overstocked, and all the money I earned fell into the inventory. I feel SHEIN.

Start by growth, the success or failure of the supply chain. The secret of success in doing e-commerce.

Reviewing the development of SHEIN, I think three points determine the success of SHEIN:

1. Quickly launch new products that cater to the market;

2. Efficient supply chain;

3. Excellent web celebrity marketing growth strategy.

The success of SHEIN is a story of the right time, right place and people, without anything, it is impossible to create such a “strange” successful enterprise.

The developmental history of the SHEIN

SHEIN was founded in Nanjing in 2008, and its founder Xu Yangtian started from the background of SEO.

From 2011, it was only a wedding sales platform, similar to Lanting Collection order. Due to the high gross profit of wedding dress product line, it completed the initial original accumulation of the dividend period of Google and facebook advertising traffic at that time.

Because of the partners sake, see the net red with goods opportunity. Just send samples to some Internet celebrities and give them to try on, just share the purchase link on social media.

In 2012, the model of SHEIN was gradually changed from advertising to web celebrity with goods. This period slowly changed from the wedding dress category to womens clothing, and gradually developed the United States, Spain, France, Germany, Russia, Italy and other regions.

At that time, SHEIN was still bought from various clothing markets, sold on the shelves, but was not involved in the design and production link.

With the traffic growth of SHEIN, orders exploded. Due to the limited inventory and the lack of control over the supply chain, it often could not be replenished after selling out, resulting in some losses.

Later, Xu Yangtian began to start the idea of the supply chain and went to Guangzhou.

In 2015, SHEIN opened the company to Guangzhou Panyu, backed by the worlds largest garment textile market, owns the garment processing base in Panyu Nancun Town, explored a new model in the production supply chain, gradually formed its own supply chain ecological barriers; establish supply chain center, build supply chain system, began to develop and design independently, build storage system.

Since then, SHEINs growth iron triangle has been formed, starting the real take-off road. By 2017, it had covered 224 countries and regions.

Since SHEINs pricing range is mostly between $5 to $30, far lower than fashion brands such as Zara, it has been wildly loved by female consumers around the world, and some consumers even describe SHEIN as “paradise”.

Times make heroes, SHEIN meets the epidemic, offline consumption declined, and consumers in many regions have turned to online.

SHEINs GMV grew two or three times in 2020 and has been booming since 2021, recently planning a listing in the US.

What is the core growth code for the $100-billion-valued giant? I will try to interpret it.

Quickly launch new products that cater to the market

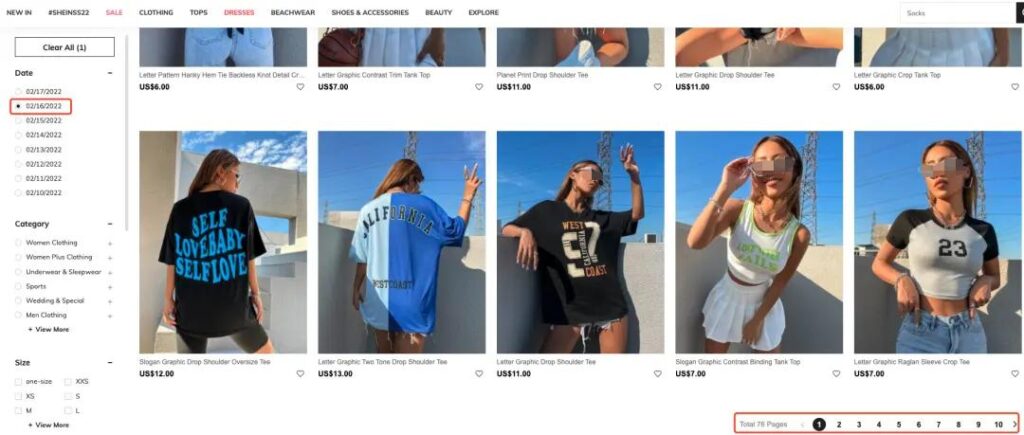

As I write this article, 9,120 new items were added to SHEIN, which makes the new scale incredible. The speed of global fast fashion giants every day on 30 new pieces has surprised industry insiders. Although the two models are different, we can also see the competitiveness of SHEIN in product power.

SHEIN has a set of intelligent design system inside, the elements of the clothing is very detailed, neckline, cuff, hem, color and other elements, each element has a different material library, plus the cloth and other related factors, a little change of an element can be recombined.

In this way, the design becomes a mathematical combination problem. The design team only needs to contribute the basic material library to the design system, and then do screening. On this basis to do certain optimization, you can make the factory.

SHEIN has a strong design and board modification team, has a huge design team, the past design experience can feed back the intelligent design system, but also can enrich the design elements.

In fact, the essence of e-commerce clothing category sales is selling pictures, SHEIN pays great attention to product pictures from the beginning, product pictures are taken by foreign models, carefully shot and revised pictures, in line with the aesthetic style of Europe and America.

With the help of efficient supply chain, the design drawing of SHEIN can quickly turn into physical goods. The production mode of “small order quick return” allows SHEIN to complete the whole process from design to shelf sales in a 7-day cycle, 7 days faster than ZARA.

Efficient supply chain system

Supply chain is the soul of SHEIN, and it is also the core of the many independent station platforms. Now a core barrier, an insurmountable obstacle for the new imitator.

In conclusion, I think SHEIN has the following competitiveness in the supply chain.

1. Panyu Garment Industrial Belt;

2. Small order quick return mode;

3. Digital manufacturing system;

4. High inventory turnover;

5. Scale logistics system.

1. Panyu Garment Industrial Belt

China lies in the supply chain advantages without repeating, backed by Chinas clothing industry belt, SHEIN this supply chain mode and play can be realized.

From 13 lines to the fashion garment production and wholesale market, Guangzhou plays an important role in the garment manufacturing industry. Panyu is located in the central and south of Guangzhou. People who have been to Panyu know that there are many small workshops here, backed by the worlds largest garment and textile market, SHEIN has explored a new supply chain model here.

Why are these factories willing to accompany SHEIN growth? SHEIN is not only very comfortable in the account period, but also take the initiative to subsidize the factory funds, bear the high cost of the sample clothing plate work, and even invest money to help the factory expand the scale.

When SHEIN selects suppliers, it even requires within 2 hours drive, so that the design and production communication will be more smooth.

The garment factory and SHEIN have a mutually beneficial relationship. If SHEIN took advantage of the industrial advantage of Panyu at the beginning, with the development of SHEIN, the growth of its order scale promoted the development of these garment workshops. With the development of SHEIN, many garment factories are constantly expanding their scale and cooperating with SHEIN for many years, with high stickiness.

2. Small single quick return mode

A style wants to do 100 pieces, or even 10 pieces of small order, and then according to the market feedback to fill the order, this mode is called “small order quick return”. At the beginning, no factory was willing to accept this model, because the startup could not cover the cost. SHEIN settlement speed is fast, and there are subsequent orders after finishing, more and more factories are slowly accepting “small orders fast return”.

SHEIN Through small order production, after the market according to the sales situation quickly feedback to the factory, forming the core competitiveness of inventory and sales linkage.

3. Digital manufacturing system

SHEIN is typically five to seven days delivered, seven days faster than fast fashion giant ZARA. It has to be said that SHEINs supply chain digitalization not only promotes the supply chain informatization within SHEIN, but also makes a digital manufacturing system for the factory.

The factory can receive orders from SHEIN on the system and provide a cloth platform to place orders for the factory. SHEIN provides systems that can even control every worker on the production line, assign tasks to workers and pay wages.

We have been talking about intelligent manufacturing, and SHEIN this order source control may be one direction.

In addition to manufacturing, SHEIN has done deep digitization in inventory management, warehouse management, logistics management and other aspects.

4. High inventory turnover

Friends who know the clothing industry should know that the gross profit of womens clothing is very high, can reach 60~70%, but the vast majority of enterprises can not make money, cash flow is very poor, why?

“Inventory” is the natural enemy of clothing, because the clothes are seasonal and timeliness, miss the opportunity to become inventory.

For example, 100, if 80 are sold, 20 are overstock. The way to handle may be the tail goods, if it is a brand, it may not be able to deal with, resulting in inventory backlog.

The sales of Heilan Home in 2020 is 17.9 billion yuan, the inventory value of the industry is 7.4 billion yuan at the end of the year, and the total profit is 2.29 billion yuan.

SHEIN verifies new products through small single and fast trans, and improves inventory turnover by shortening the inventory cycle. Different from the long purchasing cycle of other clothing brands (2~3 months), SHEIN products are generally only prepared within four weeks, and the replenishment is accelerated. Without selling, there is enough cycle to clear the inventory through promotion.

5. Scale logistics system

Logistics is the natural enemy of cross-border e-commerce, which is not only expensive, but also long time. The size of SHEIN orders gives him more options, including single shipping, and even charter flights in some countries. Not only can reduce the logistics costs, the time limit has also decreased accordingly.

Excellent web celebrity marketing growth strategy

According to Similarweb, 126 million people visited SHEIN in January 2022. The APP side is the most downloaded shopping APP in the global market, surpassing Amazon.

What is the secret of SHEINs traffic growth?

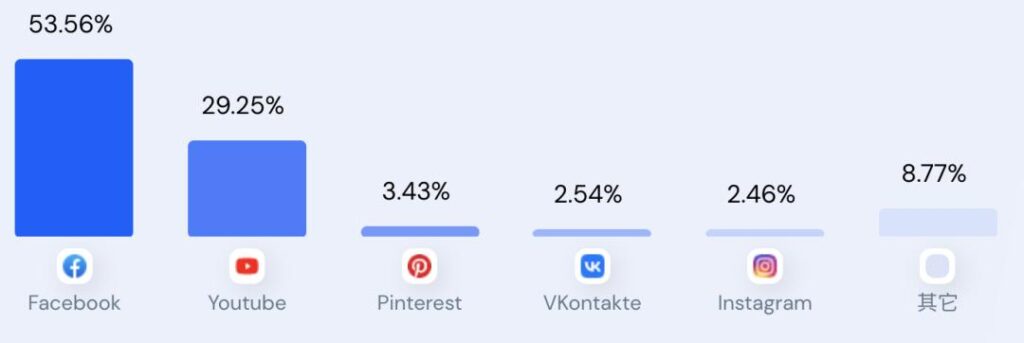

Lets look at the flow structure of SHEIN, as shown in Fig:

Search was the most traffic, with 45%. Natural traffic and paid traffic account for 50% each. Natural traffic is the Google SEO optimization, paid traffic is mainly Google ads.

Direct traffic accounts for 38%, which is the second channel, indicating that the SHEIN brand has accumulated many loyal fans over the years. Users remember the SHEIN site, and this part of the traffic is free.

Social traffic accounted for 7.23 percent of the social traffic, including free social media and paid social advertising. From the proportion of social traffic, we can see that SHEIN has really done a good job in social network marketing. Later, we will then analyze this part of social traffic in detail.

Others are email, display advertising and external chain, these traffic channels basically account for about 10%.

SHEIN has been investing in marketing since the early days of social media in 2011, and also enjoyed early dividends. According to previous reports, Xu Yangtian revealed that the ROI at that time was 3:1.

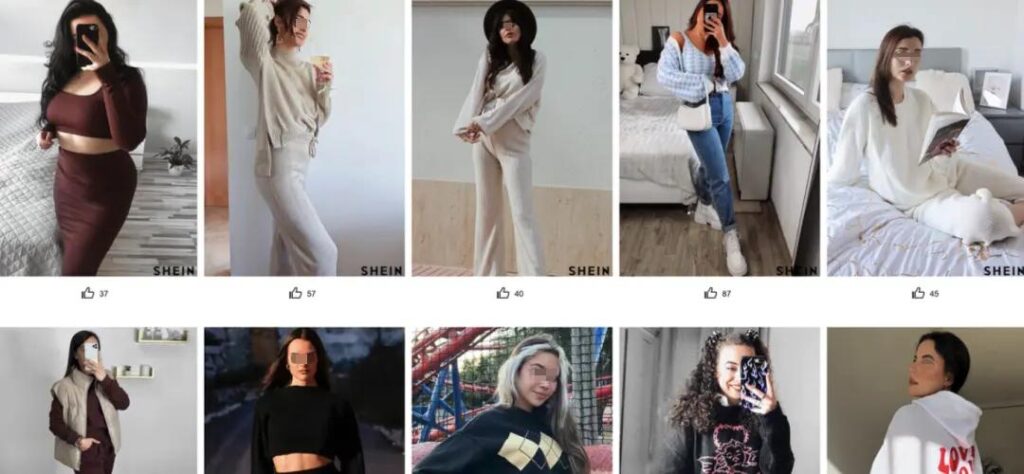

At present, SHEIN has tens of millions of supporters in major overseas social media channels, and realizes social fission through web celebrity recommendation and user comments. Pay great attention to the feedback of Internet celebrities and fans, and the company will make production planning according to the advertising feedback of products. SHEIN has web celebrity resources ahead of its competitors, and web celebrity resources in some market segments can effectively enhance product recognition.

SHEIN cooperated with a large number of various types of web celebrity, mainly clothing, beauty makeup and other types, hundreds of fans, millions of millions of fans, to do small web celebrity do traffic and chain, the central web celebrity with goods, the head of the net red to do brand communication. Web celebrity evaluation methods include package unpacking, real trial commentary, real comments and other ways, through free clothes and samples web celebrity to try on.

In addition, with the wave of TikTok growth, SHEIN began to incubate its own web celebrity accounts, and effective.

In addition to using web celebrity marketing, SHEIN also released the Alliance Channel (Affiliate Program) program, similar to Taobao customers.

If users promote SHEIN on social platforms (Instagram, Youtube or TikTok), potential customers can get 10%~20% commission of the transaction volume, which is higher than the commission ratio of Taobao customers.

The logic of SHEIN alliance channel plan can be realized is: First, the gross profit rate of clothing category is above 60%, but the unit price of SHEIN products is low and the conversion rate is high, and the participants can obtain considerable profits.

It is millions of ordinary people to web celebrity to promote SHEIN, to bring considerable traffic to SHEIN. These users are not only loyal consumers of SHEIN, but also recognize the products and brand tone of SHEIN, and can also bring themselves considerable commission when sharing conveniently.

The effect of affiliate marketing can not be ignored, and the traffic is continuous.

When we subdivide SHEIN social media, we can see that Facebook accounts for 53% of the traffic, which is the largest traffic channel, followed by Youtube, nearly 30%, Facebook and Youtube, two social media account for more than 83%. Others are Pinterest, INS and other channels.

Excellent web celebrity marketing growth strategy makes SHEIN traffic no longer limited by high cost of advertising. Through web celebrity marketing, it can not only improve traffic, but also improve brand awareness, establish a wide range of user awareness, the effect is excellent, which other latecomers can not span.

Sum up

Start by growth, the success or failure of the supply chain.

The growth path of SHEIN is unique and cannot be replicated.

The SHEIN team achieved the best traffic dividend from the rapid growth of social media over the past decade; relying on a mature and efficient supply chain in China, using digital capabilities to improve the efficiency of supply chain collaboration; and doubling the GMV during the epidemic.

Without any link, it is difficult to reach today, ZARA walked 47 years, Uniqlo nearly 70 years, and SHEIN took ten years to catch up.

The growth road of SHEIN is the epitome of the road of Chinese cross-border e-commerce enterprises going overseas. The growth of Anke Innovation, OnePlus, Xiaomi and other enterprises all indicates one of the growth paths in the next period: going overseas.

The broad market of globalization is waiting for Chinese enterprises to explore.